Accepted formats

Not just convenience, but a tool for profit

The more expenses, the less taxes

The more expenses you declare, the less taxes you have to pay. Accounting is not about tables, figures or folders of receipts. It's about control. So you can grow your business, instead of processing receipts at the last minute

Receipts are no longer lost

There is no longer a need to send photos via WhatsApp or keep receipts in your pocket. They fall out of your pocket and the receipt is lost.

Everything registered and on time

Forget about late nights before reporting deadlines – everything will already be in the system. Photograph, confirm, record the expense. And keep working

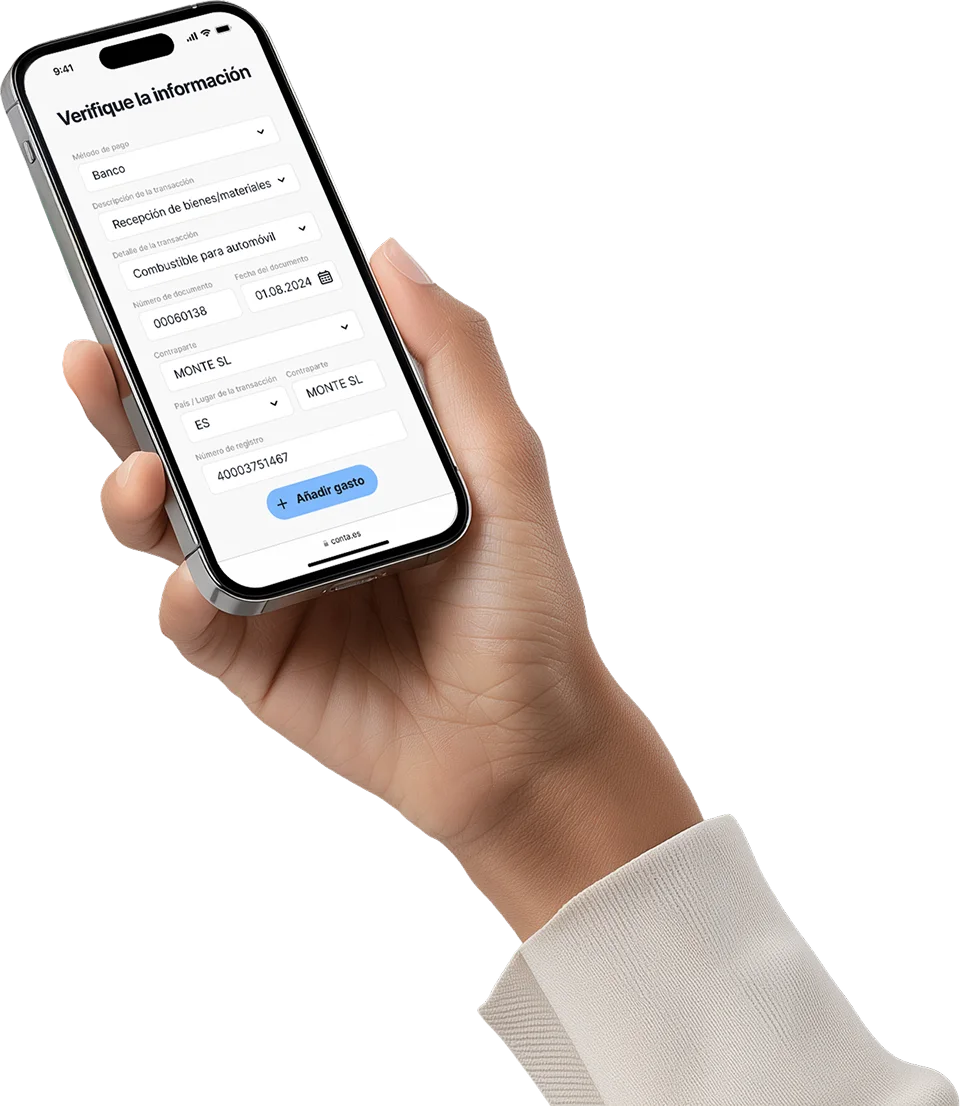

And what about the invoices? Painless automatic processing

The system learns from you

Upload it once: the system learns the category. Next time you will just have to check and confirm.

Detects changes and gives advice

The system detects if the volume increases, decreases or seems suspicious. It recommends what, how and how much you can deduct.

Less clicks, more clarity

Telephone, internet, software, hosting, advertising on Google. These invoices are repeated, but you no longer have to register them again each month.

Invoice paid immediately

Simply scan it and you can make the payment directly in the system. No unnecessary steps, no copies, no data entry.

What do clients register most frequently?

Fuel, office supplies, licenses

Representation expenses: meetings with clients, gifts

Partially deductible expenses (e.g. 50% internet, electricity)

Business travel expenses

Main functions of the system

What do customers say?

Frequently asked questions

The same can be done with an invoice and, if it is not yet paid, it can also be paid directly through the system.

As long as your subscription is active, your profile data will be retained along with any accompanying receipts or invoices.