How does it work?

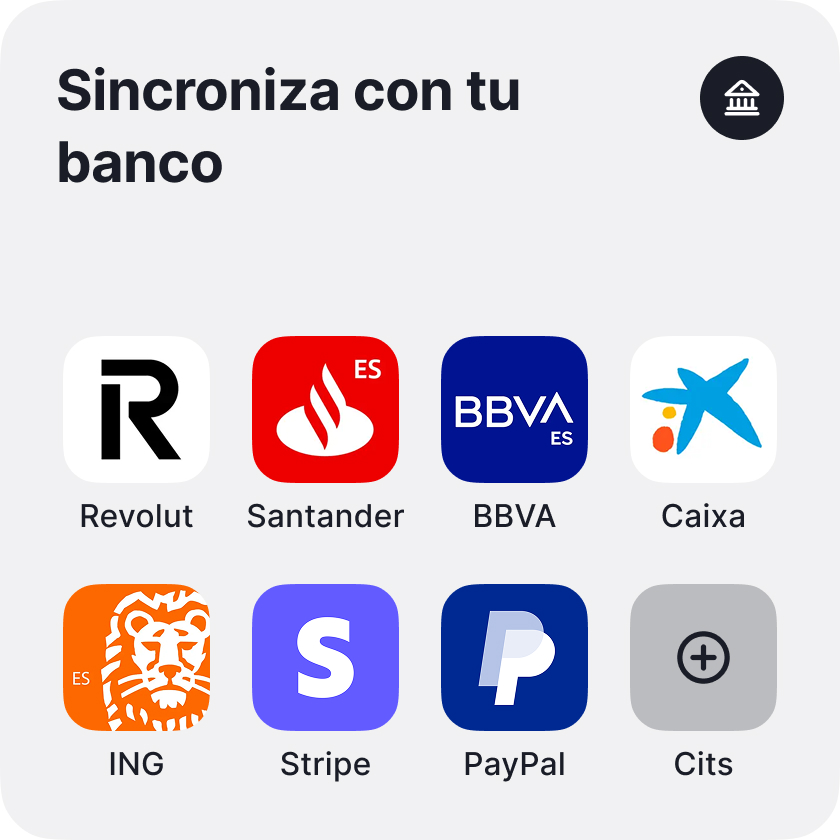

Add account

Choose your bank (BBVA, CaixaBank, Santander, Revolut, etc.) and authorizer through a secure connection

Import transactions

Press “Update statement”: all the most recent transactions will appear in the system

Mark and process

Press “Create” or “Link transaction”

How does it help on a daily basis?

You pay the fuel

The transaction is seen immediately in the system

Paid parking or office supplies

They are no longer forgotten

Receive a commission or repay a credit

Everything accounted for

Split or classify expenses

It's also simple

Security without compromises

Connection via GoCardless

PSD2 service provider with European license and high security standards

No access to storage

We do not see or store your banking username or password

Data on secure EU servers

All information is encrypted and stored in secure repositories in the European Union

How much does it cost?

Services

- Necessary documents always at hand (up to 10)

- Invite an accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices a month

- Language selection

- Choice of invoice design

- Add your own logo

- Electronic invoice

- Direct payment button on the invoice

Main functions of the system

What do customers say?

Receive only what you need and find useful.

Frequently asked questions

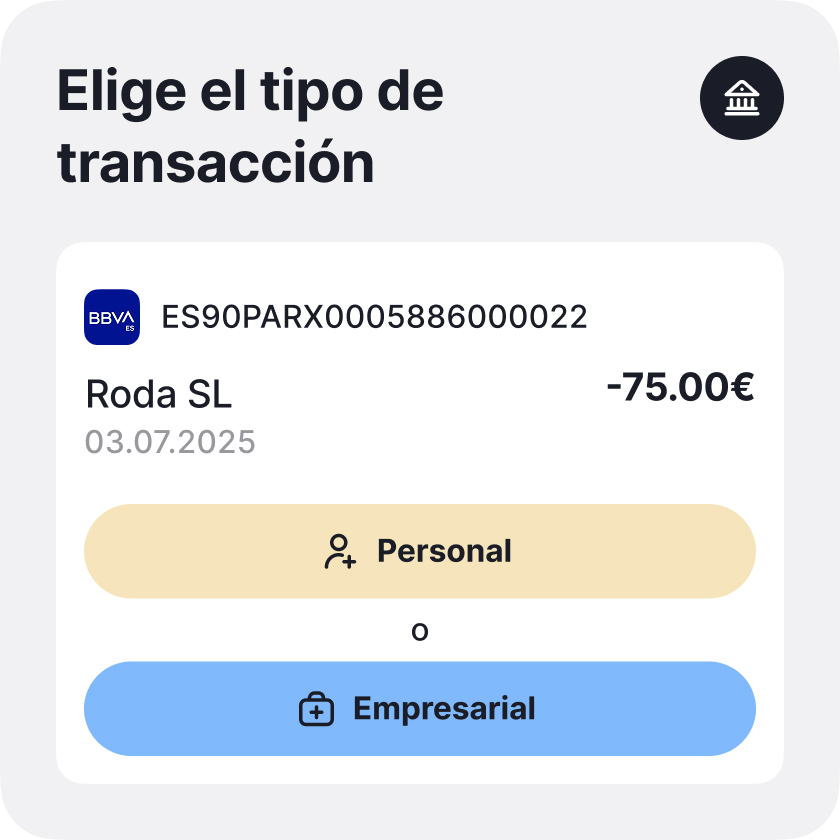

In the case of a self-employed person, you can also use a personal bank account for economic activity; In that case, it will be necessary to indicate in each transaction whether it corresponds to a personal expense or income or to professional activity.