Analytics and tips for recording expenses

See what others deduct

Get advice

Less taxes is more profit

Correct registration helps save more

Business is not just about income. Business is about income and expenses together. The less you deduct from what you can, the more taxes you pay. And that means: lower profits, fewer opportunities to grow, unnecessary taxes.

How does it work?

The algorithm analyzes your:

Income and expense ratio

Typical costs in your sector or a similar one

Relationship between billing and expenses

Show what you have forgotten or possibly overpaid

The system uses artificial intelligence to show opportunities where still You have not taken advantage of everything allowed.

Who is it intended for?

Without manager

Suitable for self-employed people who do their own accounting. Receive tips to deduct more and pay less taxes.

For small businesses

Designed for small SLs that want to manage expenses strategically. See industry averages and savings opportunities.

See what others do

For those who want to see what others take advantage of but they don't yet. The system shows what you may have missed.

Less taxes, more profits

For all those who want to pay less. Analytics helps to deduct more and increase profits.

How much does it cost?

Services

- Necessary documents always at hand (up to 10)

- Invite an accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices a month

- Language selection

- Choice of invoice design

- Add your own logo

- Electronic invoice

- Direct payment button on the invoice

Try and notice the difference

Chance

Chance

Chance

Chance

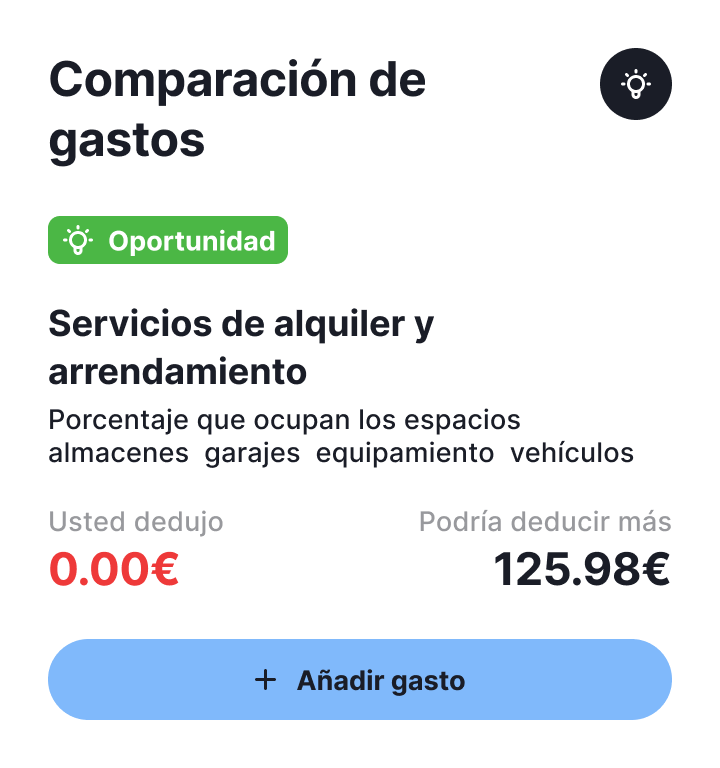

- Do you want to see what you haven't deducted yet?

- Or how much do you pay more compared to others?

Keep accounting correctly. That is the difference between stagnation and growth.

Main functions of the system

What do customers say?