Easy accounting on your own

Economic

At an affordable price, with tax recommendations and automatic reports

Less time spent on accounting

No prior knowledge required

Automatic reporting and easy control of income and expenses

Less time spent on accounting

Save time

Issue invoices, photograph receipts, sync bank account

Main functions of the system

Receive payments without a terminal

Instantly with a QR code or link: ideal for those offering services without a cash register. Create the offer, the customer scans it and makes the payment

Recognition of receipts and invoices

Automation that really pays off! Save up to 80% time compared to manual data entry

Issue invoices and receive payments faster!

Automate the invoice issuance process, receive payments faster and spend your time on what really drives your business

Reports and fiscal calendar

All reports and statements are generated automatically, from quarterly to annual summary. Just enter your income and expenses: the system will calculate the taxes for you, and you will only have to download and file the return

Banking integration and payment management

The fastest way to record your commercial operations: correct and transparent.

Analytics and tips for expense control

Discover what expenses other freelancers in your sector deduct, receive recommendations and reminders about forgotten expenses

Registration in 1 minute

Start doing your accounting yourself! In an easy and understandable way!

Fewer clicks, faster start. With conta.es, everything starts automatically.

Registration completed. You have 7 days to try everything.

An accounting system with everything you really need

An invoice with your logo, in a minute.

Choose the invoice design, add your logo and you can send it. It looks professional and convincing.

Send the invoice to the client in the way that is most convenient for them

Choose how to send the invoice: by email, WhatsApp or as a QR code. Fast, comfortable and without unnecessary steps.

See how much you have to pay each month

VAT, personal income tax and social contributions in one place. Compare periods and track tax changes at a glance.

Always see how much you have earned

Profits, expenses and results: all clearly visible. No searches. Everything well organized.

Synchronize your accounting with the bank

All transactions under control: much easier to do accounting. Less manual filling! (soon).

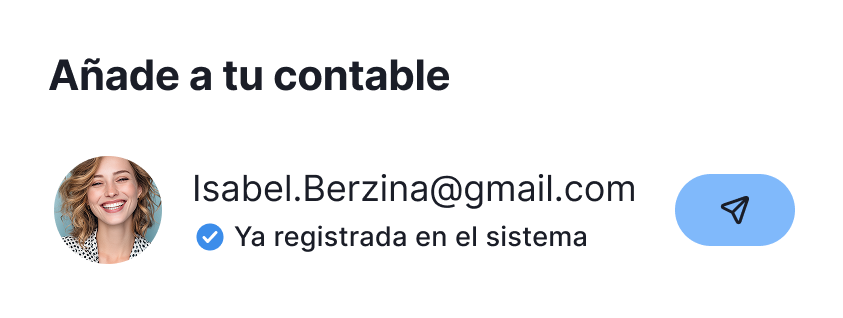

If you need it, add your accountant

The accountant views transactions and bank statements. There is no need to search for files or unnecessary communications; everything is clear and organized (coming soon).

Payroll module - coming soon!

Forget the calculator. Calculate salaries, overtime and vacations automatically.

Tax deadlines - always visible

Deadline reminders. Mark as completed or add to calendar: everything under control.

So what do you get in the end?

Less routine, more focus on business

Invoices, alerts, tax calculations – it all happens automatically. There is no more Excel or manual reviews.

More confidence and peace of mind

All your money flow in one place: you see how much you earn and what you can deduct as justified expenses.

Order in finances

VAT and personal income tax returns are prepared automatically

Invoice sent: payment is on the way

Invoices with status: you see what is paid, what is late and where you need to act. Without having to ask. Without uncertainty.

We work alongside market leaders

What do customers say?

How much does it cost?

Services

- Necessary documents always at hand (up to 10)

- Invite an accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices a month

- Language selection

- Choice of invoice design

- Add your own logo

- Electronic invoice

- Direct payment button on the invoice

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

- Record of operations from the current month

- Scan receipts and invoices

- Fixed asset register (coming soon)

- Automatic receipt of bank statements

- Invoice issuance

- Analytical recommendations for expense deduction (coming soon)

- Remote acceptance of payments by card or bank transfer

- Payroll registration (coming soon)

- Quick questions to an accounting and tax expert (coming soon)

Receive only what you need and find useful.

Frequently asked questions

The calculations are made automatically from the invoices issued and the expenses recorded, without the need to perform manual calculations.

However, conta.es helps you once you are registered: you can do your accounting, generate reports, prepare returns and calculate taxes automatically based on your income and expenses.

1. Register with the Tax Agency by presenting Form 036 or 037, where you indicate the start of the activity, the IAE heading, the VAT and Personal Income Tax regime.

2. Register with Social Security in the Special Regime for Self-Employed Workers (RETA), normally within 60 days prior to the start of the activity.

3. From that moment on, you will be able to issue invoices, record income and expenses, and comply with your regular tax obligations.

With conta.es, once your activity has been registered, you will only have to enter your transactions and the system will help you prepare the necessary reports and declarations automatically.