Reporting and tax calendar

Reports and statements automatically generated by the system

Income tax return direct estimate (Form 130)

Report 1-04/20/07/10 and 1-30/01

Tax Presentation with direct debit → until the 15th (or 25th in January)

*Debit to account → on April 20, July and October, and January 30 for the 4th quarter

Rent withholdings (Form 115)

Report 1-04/20/07/10/01

Tax The Treasury will charge your bank on the 20th (or the following business day). If you direct the payment, the presentation must be made until April 15, July, October and January

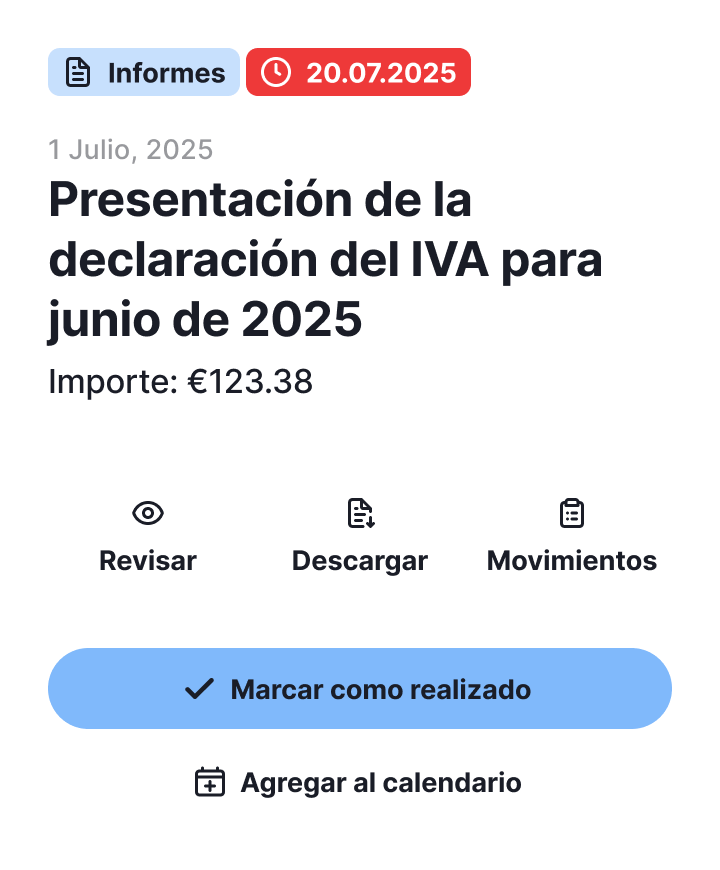

Quarterly VAT self-assessment (Form 303)

Report 1-04/20/07/10 and 1-30/01

Tax If the result of 303 is positive, it is paid at the time of submitting the self-assessment

*If you go to return it, the Treasury has a maximum period of 6 months from January 30 to deposit it

Annual VAT Summary (Form 390)

Report January 1 to January 30 for the fiscal year of the previous year

Tax It is an informative declaration (you pay nothing) where you report the VAT for the four quarters of the year

Personal Income Tax Withholdings (Form 111)

Report 1-04/20/07/10/01

Tax If you direct the payment, you must present it until the 15th of each installment

*The charge to your account is made by the Treasury on the 20th (or following business day)

Declaration of intra-community operations (Form 349)

Report April 1 to 20, July and October, and from January 1 to 30 for the fourth quarter if it is quarterly

From the 1st to the 20th of the month following that to which the operations correspond if it is quarterly

Annual rental withholdings (Form 180)

Report between January 1 and January 31 of each year

Tax It is an informative statement (you pay nothing)

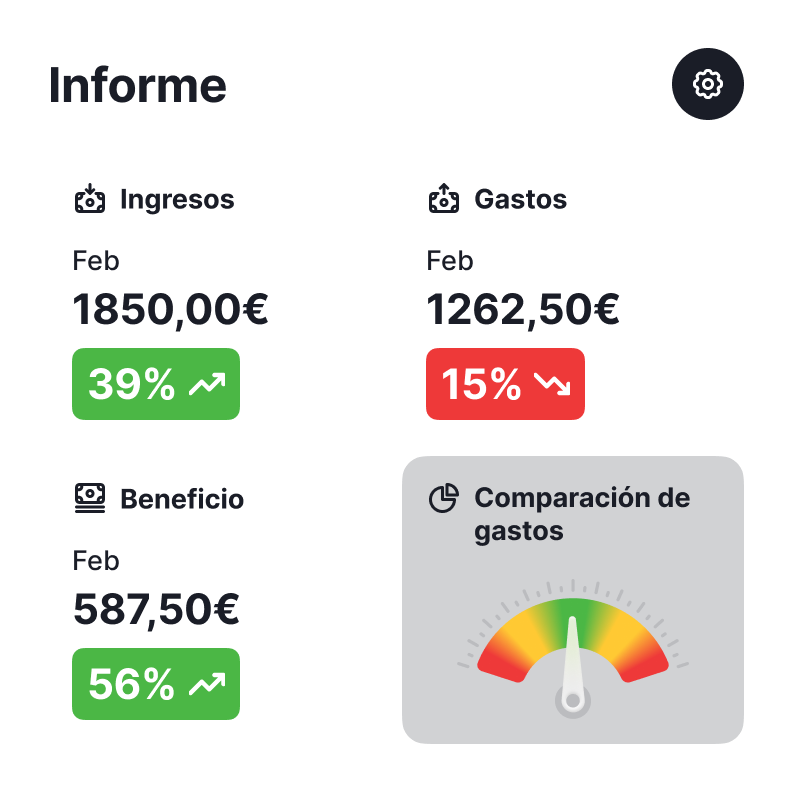

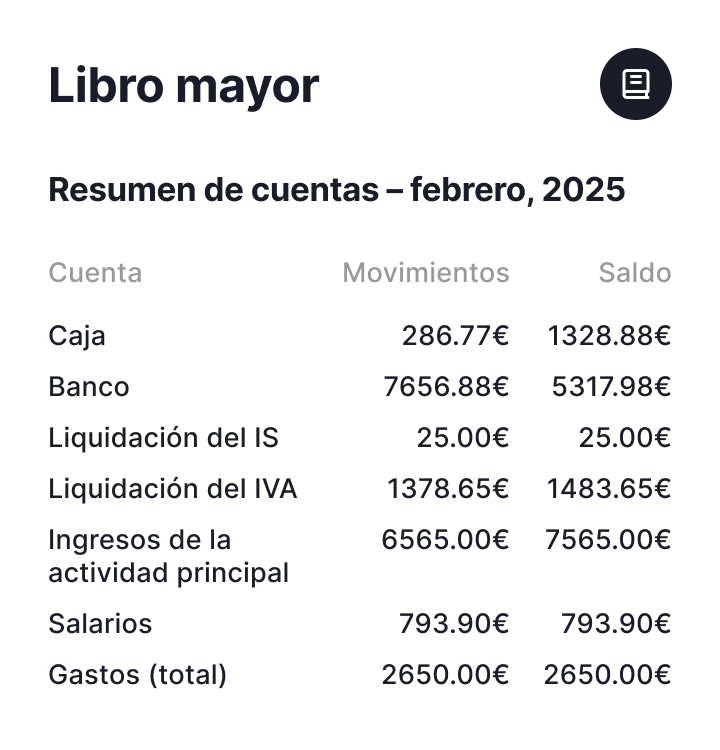

The platform makes reporting as simple as can be

Automatically Prepared File Formats

No Excel or formulas, no tables: everything is already prepared. Download and present.

All in accordance with the requirements of the Tax Agency.

Everything clear and understandable. Accounting that you control, not the other way around.

Main functions of the system

What do customers say?

Frequently asked questions

The annual returns will be available from the beginning of 2027, corresponding to the 2026 tax year.

At the moment, our system only covers Form 303 in its quarterly modality, which is the most common among self-employed workers.

When using conta.es, no accounting knowledge is required, since the system prepares the reports automatically. The user only has to enter the transactions: the income for which he receives money and the expenses he pays.

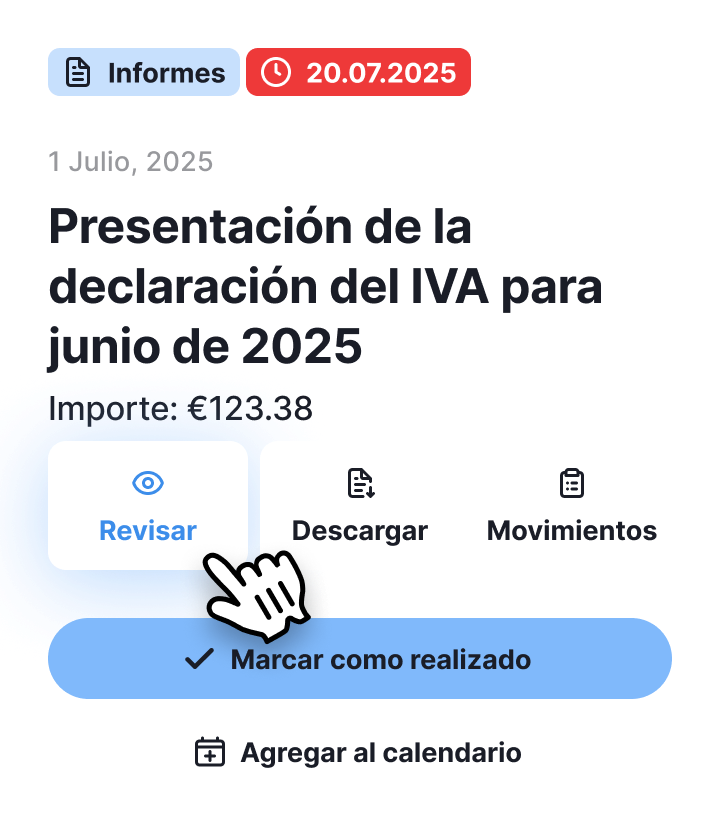

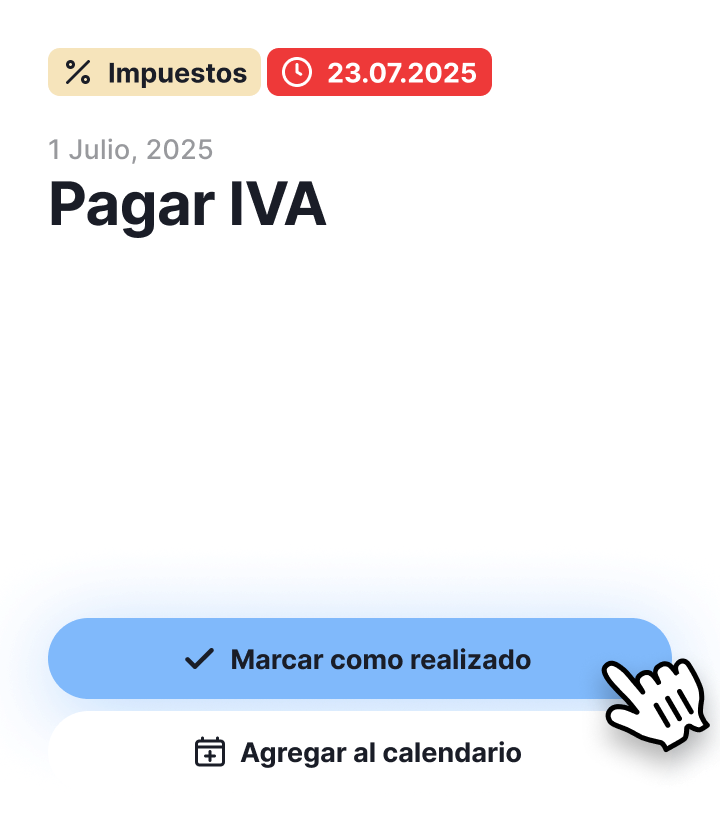

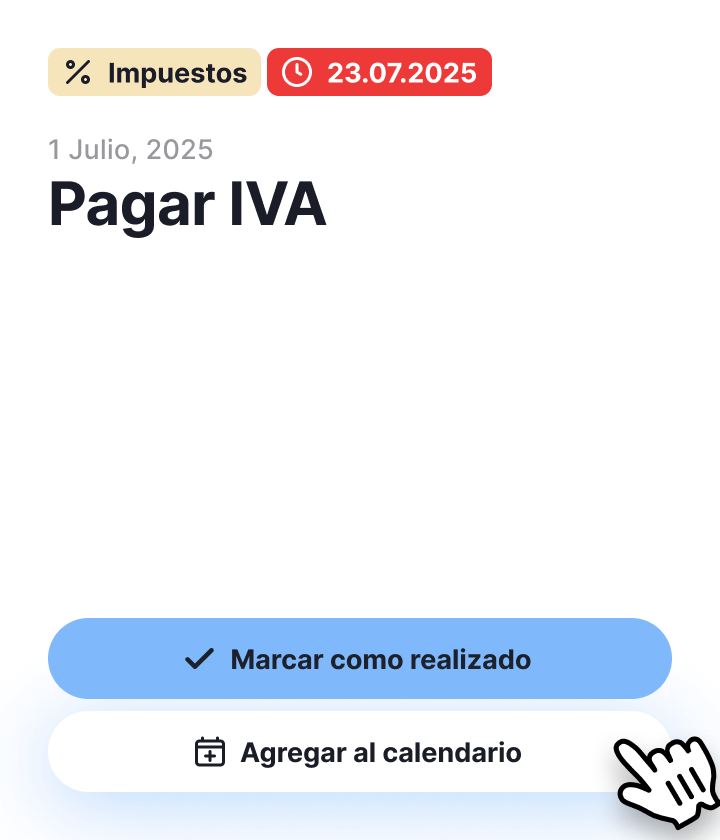

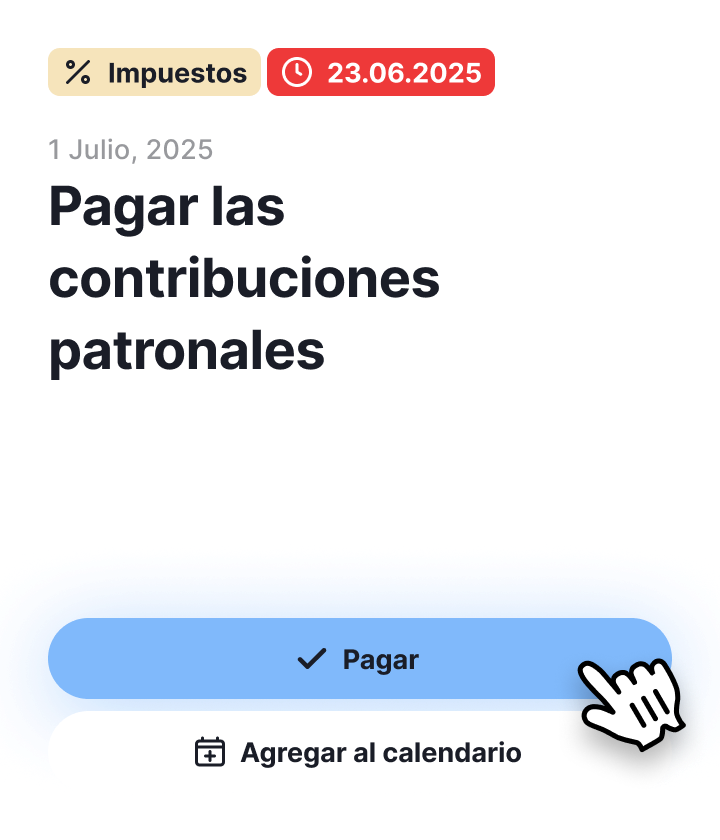

When the submission deadline arrives, the system will send a reminder and the user will only have to download the reports and submit them through the Tax Agency's Electronic Headquarters.However, when using conta.es, you don't have to worry about it: the system automatically prepares reports in the required format. The user only has to download them and present them through the Electronic Headquarters of the Tax Agency.